AI Fraud Detection in Banking

Discover how AI fraud detection works, its benefits, challenges, and why decision makers should act now to safeguard revenue and customer trust.

9/12/2025

artificial intelligence

9 mins

As people are shifting towards digital banking, we have been witnessing rising and more concerning fraud in the digital banking sector. Although digital banking is bringing convenience by allowing users to make financial transactions from the comfort of their choice place within a few seconds, the fraud involved in it is disrupting the experience and trust.

This creates an opportunity to integrate smart AI fraud detection in banking to prevent losses. An AI Fraud Detection solution in the banking sector can help in identifying potential fraud, its source, prevent account takeovers, reduce false positives, and predict and prevent future potential fraud.

Through our article, we will help you discover the potential of AI fraud detection, the models that can drive this, its use cases, benefits, and challenges. So that you have all the required knowledge before implementing the solution.

What is the Impact of Fraud in the Banking Sector?

Today, users prefer digital banking for their financial flow, as it's convenient and faster. But the emerging fraud within this digital banking is compromising the system's reliability. With evolving technology and innovation, users have been experiencing new and diverse forms of fraud. This has resulted in losing millions of dollars to both service providers and end users.

Here presence of such an AI Fraud detection tool for the banking sector is extremely essential. These tools can identify potential threats, help develop a mitigation strategy to prevent fraud, and contribute to tracking the source. This can significantly reduce fraud occurrence and help ensure a safer digital banking experience. Sam Altman once said:

“A thing that terrifies me is apparently there are still some financial institutions that will accept a voice print as authentication … AI has fully defeated most of the ways that people authenticate currently, other than passwords.”

This endorses that AI holds the potential to go beyond traditional protection methodologies. It introduces advanced ways for anomaly detection, tracing the main source, enabling AI-driven authentication, and eventually preventing unauthorized access.

AI Fraud Detection

AI fraud detection in banking is actually about using AI to identify, predict, and secure the banking system from fraudulent activities. Such an AI-powered tool can analyze the underlying patterns, behaviours, and intents and identify anomalies in transactions or accounts. By handling such responsibilities, it provides real-time protection and minimizes risks and false positives, eventually strengthening the security systems for business and customers.

AI Models Powering AI Fraud Detection

AI fraud detection utilizes diverse advanced models, which are designed to analyze data differently. Each model holds a specialized ability for powering an application and eventually helps in preventing AI Fraud in digital banking. Below are key models, how they work, and their applications.

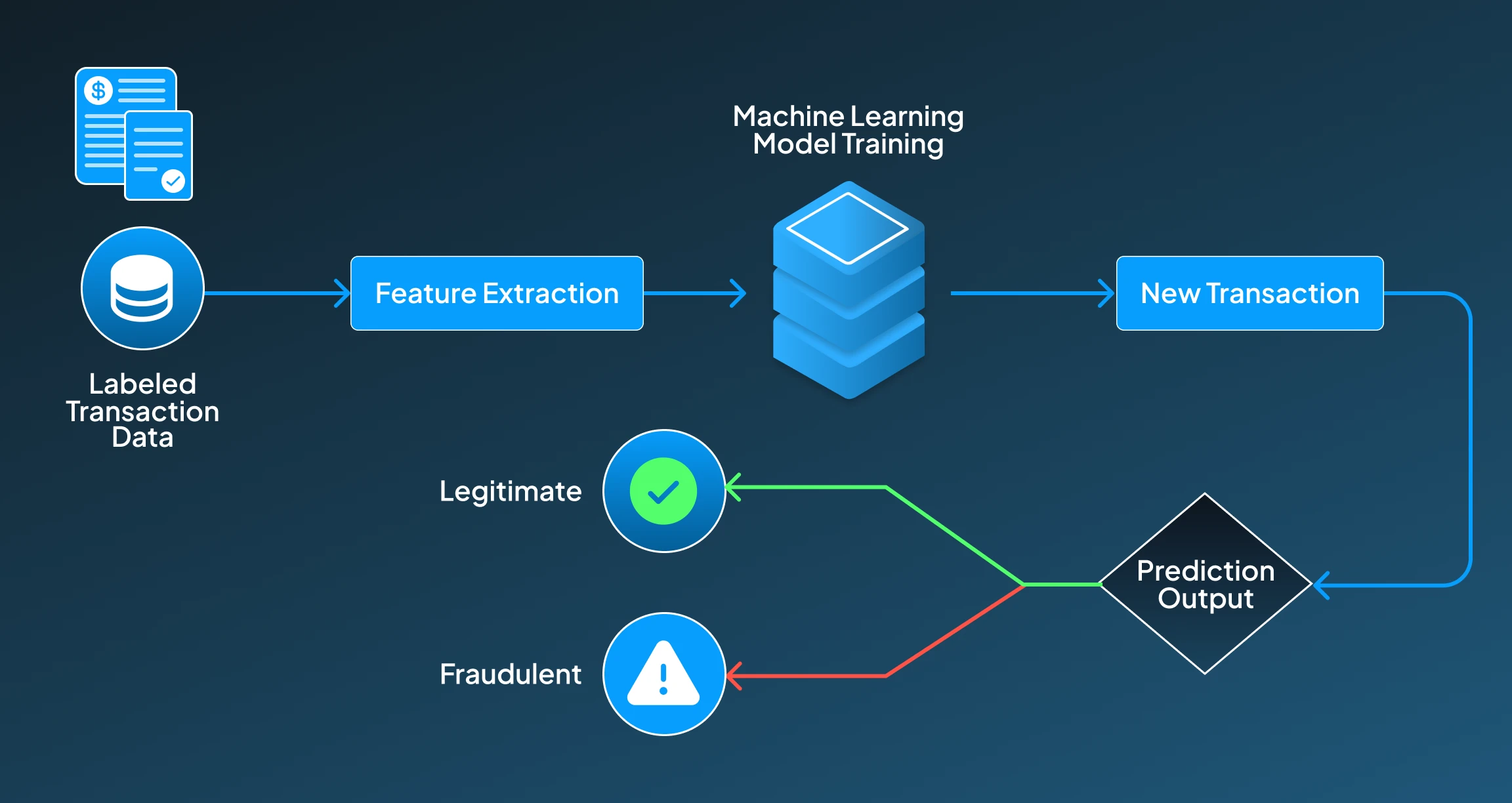

1. Supervised Machine Learning Models

- How it Works: Supervised machine learning models function by being trained on labeled datasets that contain fraudulent and legitimate cases. Such models understand and analyze the transaction features like amount, frequency, and location, further learns the patterns to identify future activities, flagging those resembling to known fraudulent behaviors.(Xuetong et al., 2019)

- Applications: Credit card fraud detection, loan application screening, insurance claim validation.

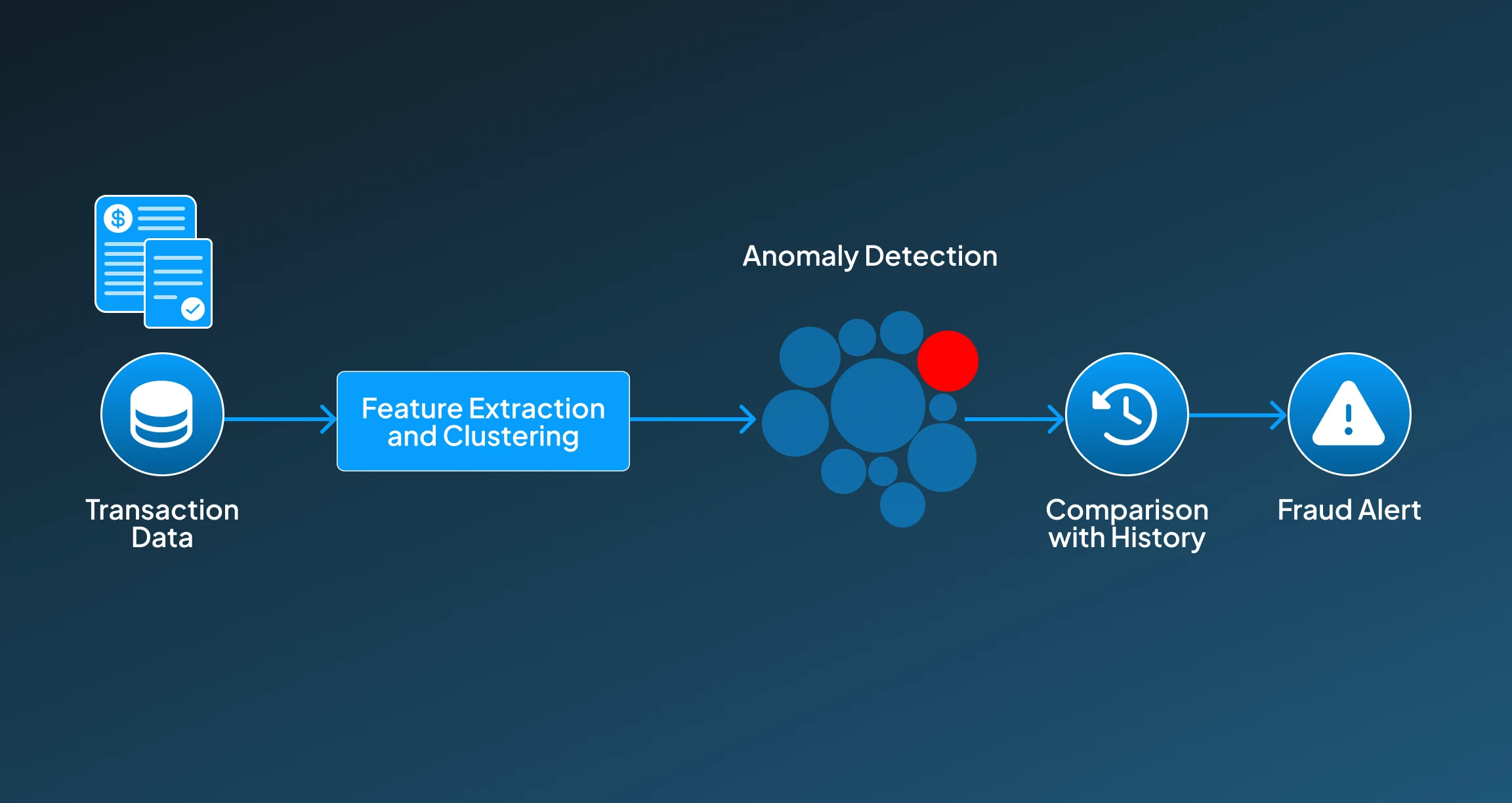

2. Unsupervised Learning Models

- How it Works: These unsupervised learning models don’t require being trained on labeled data, but instead, they can identify unusual behavior by grouping similar transactions and identifying outliers. These models can have a great ability to detect unknown fraud types. It compares recent activities with past activities to classify fraud.

- Applications: Emerging fraud detection, unusual login monitoring, and fake merchant identification.

3. Deep Learning Models

- How it Works: Deep Learning Models use multilayer neural networks to capture complex, non-linear relationships from a large dataset. Here, LSTM can identify sequential anomalies, whereas CNNs can be used for analyzing structured or visual data, making them helpful for detecting fraud involving documents or images. (Tamanna et al., 2025)

- Applications: Real-time monitoring, account takeover detection, document and receipt verification.

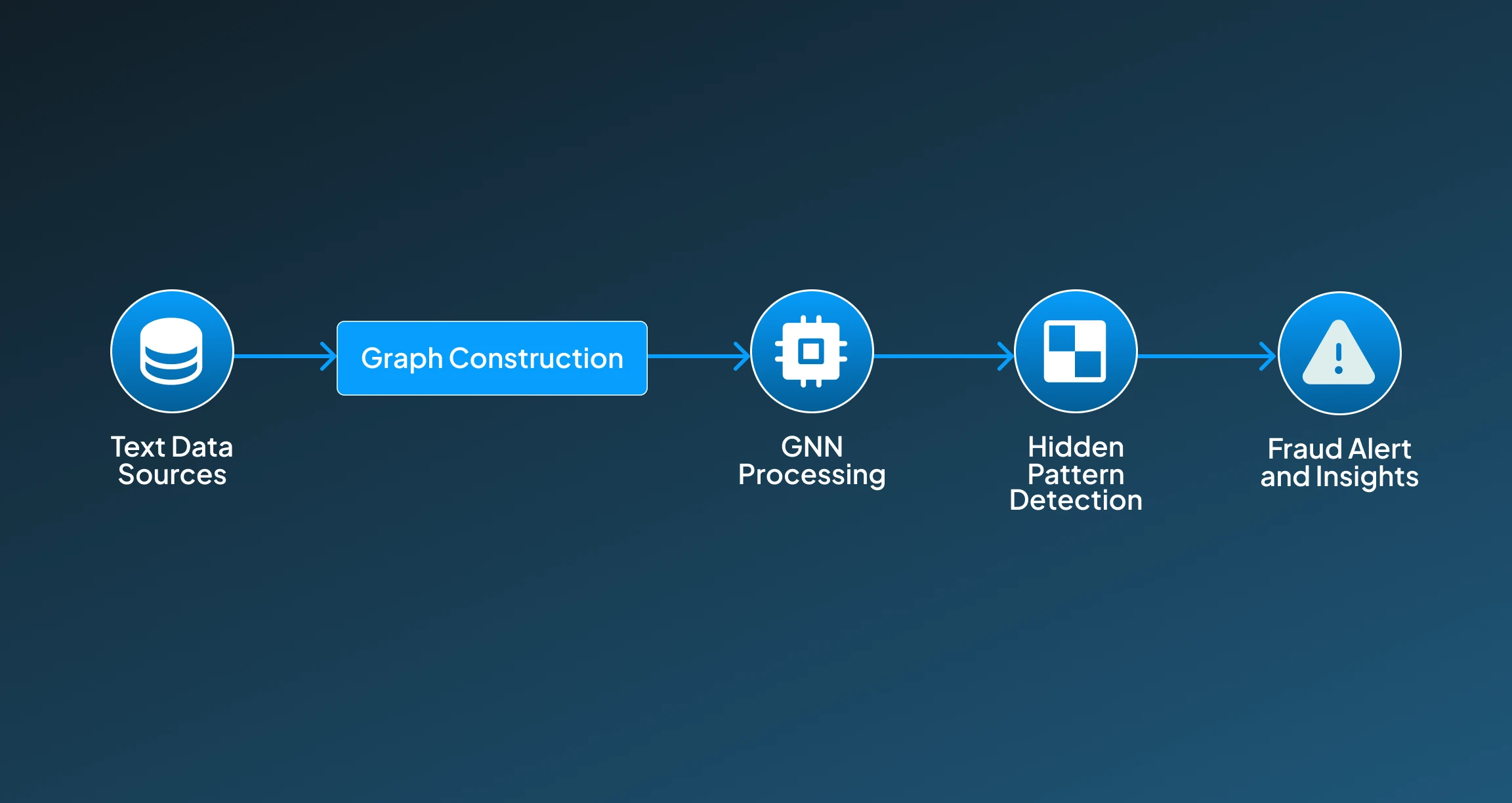

4. Graph Neural Networks (GNNs)

- How it Works: In the GNNs model, users, accounts, and devices as interconnected nodes in a network. This model works by analyzing relationships, detecting hidden collusion, mule accounts, and fraud rings that bypass the traditional systems, eventually focusing only on individual transactions. (Yajing Liu et al., 2022)

- Applications: Mule account detection, fraud ring discovery, and anti-money laundering.

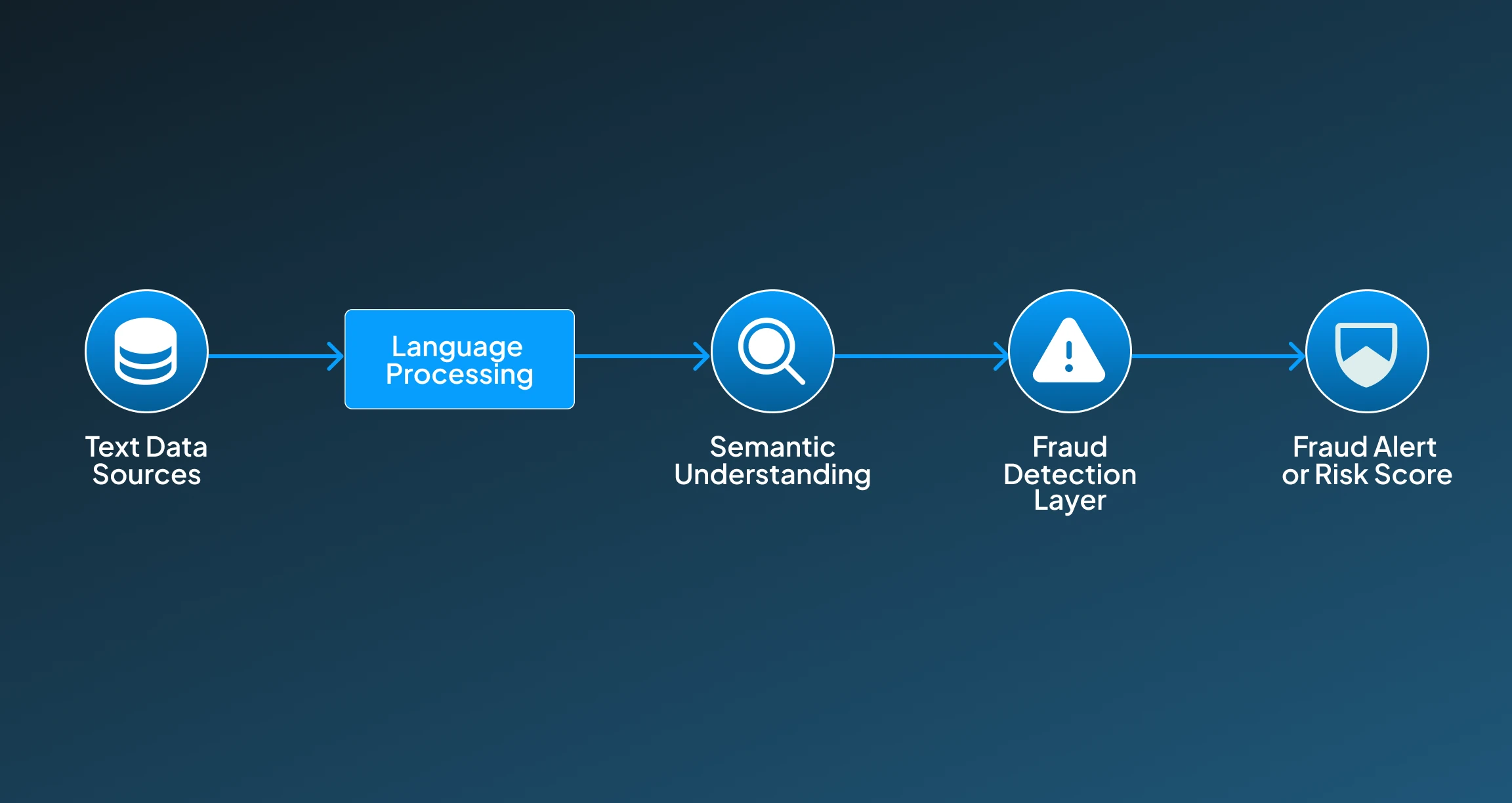

5. Natural Language Processing (NLP) Models

- How it Works: NLP models can analyze text patterns, understand hidden intent, and semantics across documents, chats, or emails. These models can understand fraudulent language cues, misleading claims, or scam attempts, and extend automated flagging of suspicious customer communications or insurance claim narratives.

- Applications: Phishing detection, fraudulent claims, scam chat analysis.

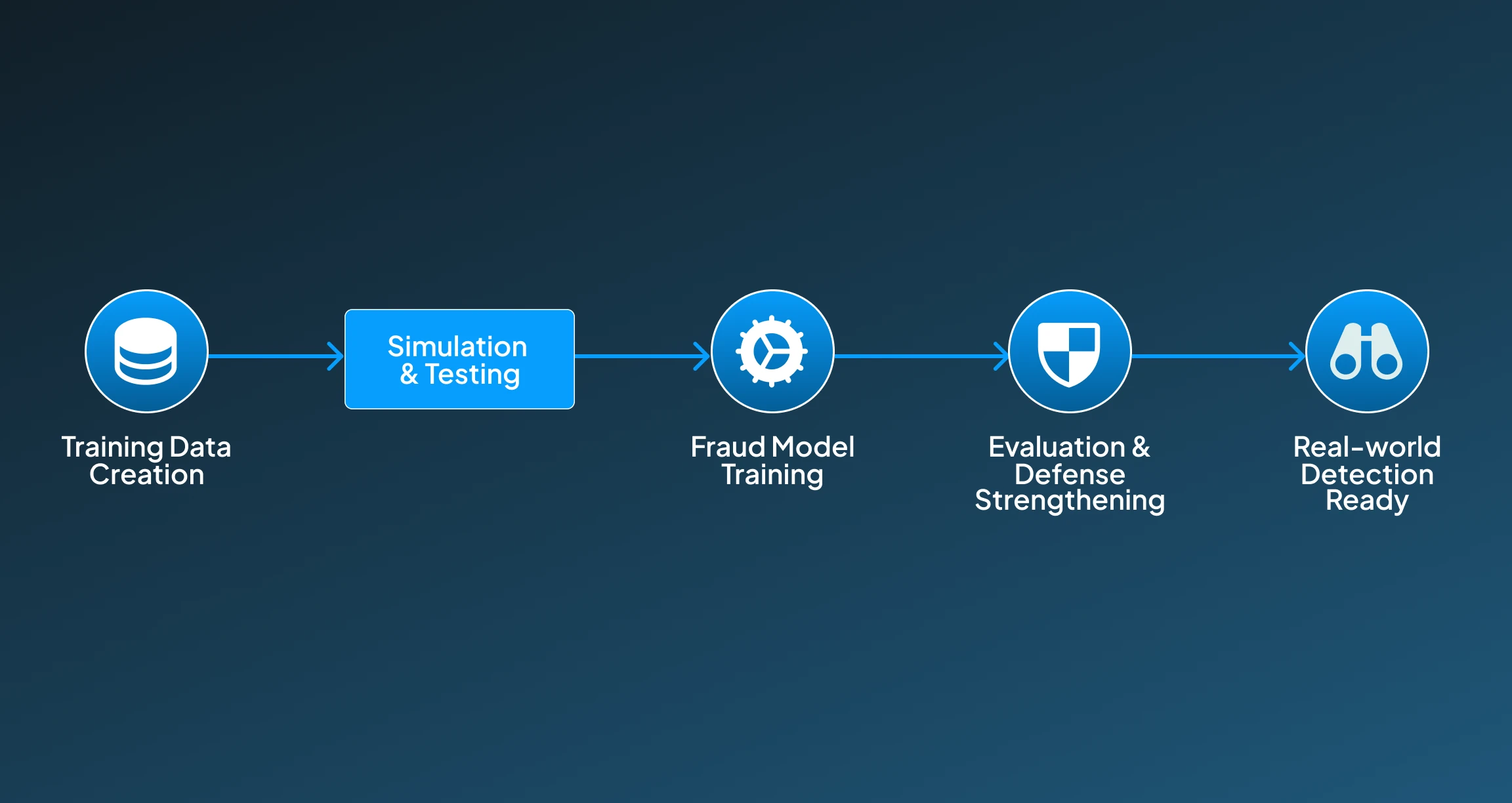

6. Generative AI Models

- How it Works: Generative AI models like GANs can be utilized to create synthetic fraud scenarios to train these AI fraud detection systems, while LLMs can be used to simulate scam conversations or identify AI-generated content. These models help create synthetic data for training the system and strengthening defenses by preparing for new fraud tactics before they occur in practice.

- Applications: Stress-testing defenses, deepfake detection, fraud investigation support.

Use Cases of AI Fraud Detection

AI fraud Detection systems can prove to be very useful for the banking sector, especially. With its advanced algorithms, it's emerging as a smart alternative to traditional practices. To provide you with a better overview of where this can be included, we mentioned a few areas where its implementation can be revolutionary:

1. Credit Card Fraud Detection

AI fraud detection systems can understand the real-time transaction data patterns to identify unusual spending behaviors, sudden large purchases, or location mismatches, limiting unauthorized activity.

2. Insurance Claim Fraud

These AI fraud detection tools can be utilized to compare claim data against historical patterns, which helps them identify false submissions, inflated claims, or duplicate requests to reduce fraudulent payouts for insurance claims.

3. Loan Application Fraud

With an AI fraud detection tool, banks can intelligently verify loan applications. By verifying each application's details and cross-checking it with credit history, income, and identity information, it can flag doctored loan applications.

4. Money Laundering (AML)

An AI fraud detection solution can identify hidden transaction patterns, unusual fund transfers, and layering schemes, eventually helping the banks comply with AML regulations and protect integrity.

5. Account Takeover Fraud

Account takeover fraud can also be significantly reduced with the integration of AI fraud detection. Such a solution can monitor logins, devices, and IPs, reporting anomalies like location changes or suspicious activities that may indicate account compromises to minimize unauthorized activities.

6. Insider Fraud

Such an AI tool can also analyze employee activity logs, monitor unusual system access, data movement, or financial approvals that signal potential internal fraud threats, to ensure a safe banking experience.

7. Source Tracking Fraud

AI fraud detection tools can help in tracing the origin of financial transactions, identifying hidden networks, mule accounts, or shell companies used to mask fraudulent activities. This contributes not only to preventing such practices but also to finding and legally acting against the source behind them.

Benefits of AI Fraud Detection

AI fraud detection in banking enables them to advance data-driven security. By using machine learning and deep analytics, such applications identify fraud in real time, adapt to evolving threats, reduce the occurrence of false positives, and provide scalable, compliant protection across industries like banking, e-commerce, and insurance.

- Real-Time Protection: Such AI fraud detection can ensure real-time monitoring of transactions instantly, identifying and blocking mysterious activities before they cause financial harm to any user.

- Adaptive Learning: Such solutions can continuously learn and adapt themselves according to evolving fraud practices and attackers' strategies, to ensure a safe digital banking experience.

- Reduced False Positives: These solutions can intelligently differentiate between legitimate and fraudulent transactions more accurately, reducing the chances of customer inconvenience.

- Scalability: An AI fraud detection solution can simultaneously process millions of transactions across banks, e-commerce, and insurance platforms.

- Regulatory Support: These solution allows organizations to meet KYC, AML, and fraud compliance requirements with automated reporting.

- Network Analysis: Such tools can identify organized fraud rings, mule accounts, and collusive behaviors through advanced relational mapping, track sources too, and prevent future fraud.

Challenges of AI Fraud Detection

Although AI fraud detection in banking results in transformative security, it also faces critical challenges. Ensuring quality data, implementation, and compliance with the standards are some main issues that these models should be addressing to ensure transparency and fairness. Below, we have discussed a few factors that stand as major challenges for these AI fraud detection models:

- Data Quality Issues: Training these AI fraud detection tools on quality data is essential. Training on incomplete, inconsistent, or biased data reduces the accuracy and reliability of fraud detection models.

- High Costs: Development, deployment, and maintenance of AI-driven fraud detection systems require a significant investment and technical expertise, which can get highly expensive.

- Bias Risks: If these solutions are trained on biased datasets, the output of AI may unfairly target certain demographics, leading to compliance and trust issues, making the results unreliable.

- Evolving Threats: Fraudsters these days are evolving and using advanced tactics like deepfakes and synthetic identities, requiring constant system adaptation; being unable to adapt to evolving fraud may make the system irrelevant with time.

- Regulatory Hurdles: It is essential to ensure compliance with strict privacy, financial, and data protection laws. So that the system doesn't face regulatory issues in the future.

- Explainability Gap: Black-box models might often struggle to justify why a transaction was flagged; therefore, it further complicates audits and makes customer explanations difficult.

Conclusion

Today, AI fraud detection, especially for online banking, is no longer optional; rather, it’s becoming a necessity. These solutions are based on advanced models like neural networks, decision trees, and ensemble methods. These help organizations to proactively combat fraud, minimize financial loss, and protect customer trust.

Despite the existence of challenges such as data quality, false positives, and implementation costs. Their strategic implementation based on continuous models training, to ensure explainability and robust compliance, can contribute more advantages for providing secure transactions

Decision-makers must act now: adopting AI-driven fraud detection not only strengthens defenses but also positions companies as leaders in risk management. The sooner adoption begins, the faster businesses can safeguard revenue and reputation, before facing any big losses because of inefficient fraud security.

How long can your business afford revenue loss before adopting AI fraud detection? Discuss with our experts at Centrox AI today, and we will help you implement a secure, efficient, and intelligent solution for your digital banking protection needs.

Muhammad Harris

Muhammad Harris, CTO of Centrox AI, is a visionary leader in AI and ML with 25+ impactful solutions across health, finance, computer vision, and more. Committed to ethical and safe AI, he drives innovation by optimizing technologies for quality.

Do you have an AI idea? Let's Discover the Possibilities Together. From Idea to Innovation; Bring Your AI solution to Life with Us!

Your AI Dream, Our Mission

Partner with Us to Bridge the Gap Between Innovation and Reality.